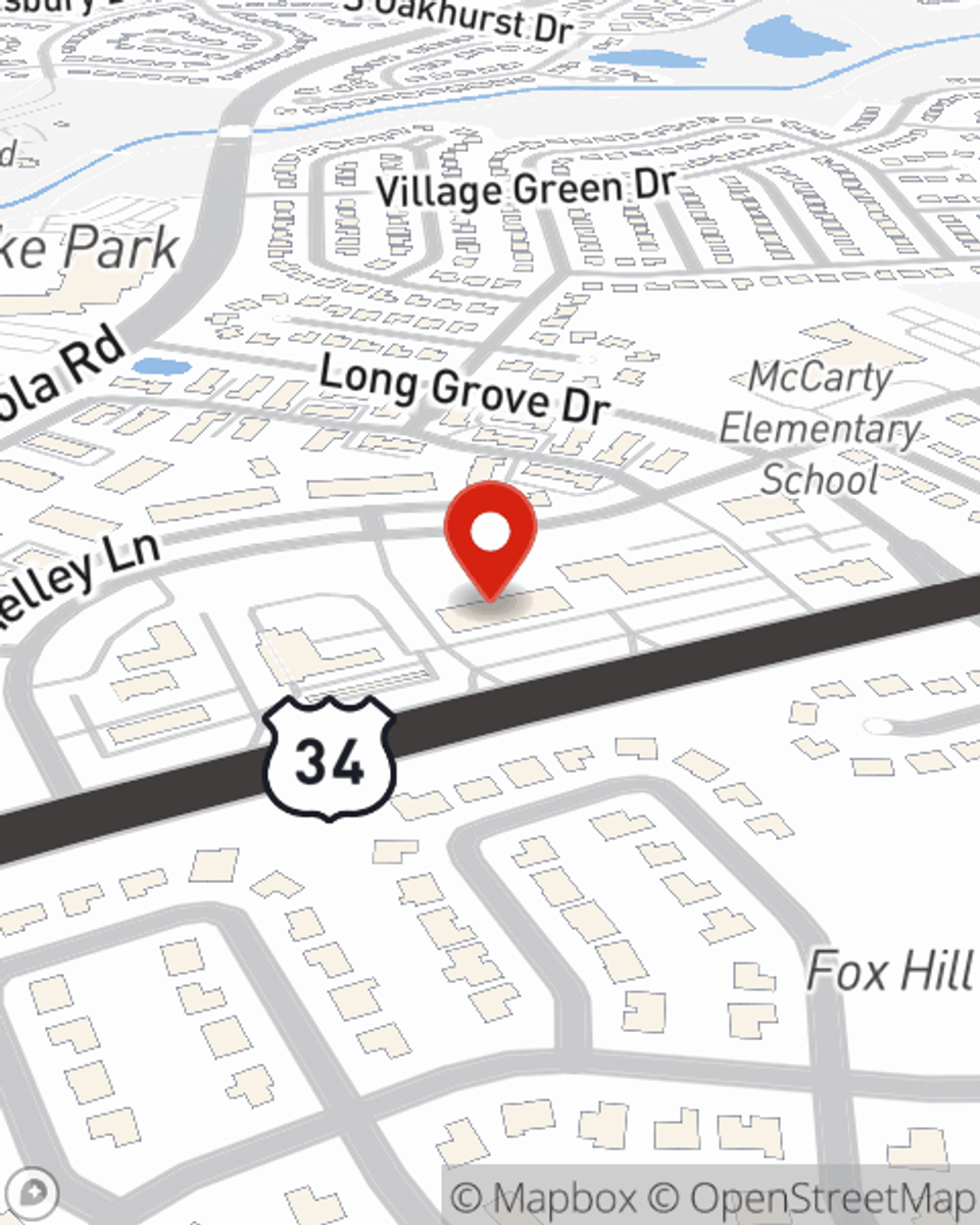

Renters Insurance in and around Aurora

Looking for renters insurance in Aurora?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Naperville

- Aurora

- Montgomery

- Oswego

- Sugar Grove

- Yorkville

- Plainfield

- Bolingbrook

- Joliet

- Crest Hill

- Romeoville

- Lisle

- Batavia

- Woodridge

- Warrenville

- Wheaton

- DuPage County

- Will County

- Kendall County

- Kane County

- North Aurora

- Glen Ellen

- South Elgin

- Downers Grove

Calling All Aurora Renters!

Think about all the stuff you own, from your entertainment center to TV to coffee maker to hiking shoes. It adds up! These personal items could need protection too. For renters insurance with State Farm, you've come to the right place.

Looking for renters insurance in Aurora?

Renters insurance can help protect your belongings

Agent Annie Kinsley, At Your Service

When renting makes the most sense for you, State Farm can help shield what you do own. State Farm agent Annie Kinsley can help you generate a plan for when the unanticipated, like a water leak or a fire, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Aurora renters, are you ready to discuss your coverage options? Get in touch with State Farm Agent Annie Kinsley today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Annie at (630) 820-5400 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Annie Kinsley

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.