Life Insurance in and around Aurora

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Naperville

- Aurora

- Montgomery

- Oswego

- Sugar Grove

- Yorkville

- Plainfield

- Bolingbrook

- Joliet

- Crest Hill

- Romeoville

- Lisle

- Batavia

- Woodridge

- Warrenville

- Wheaton

- DuPage County

- Will County

- Kendall County

- Kane County

- North Aurora

- Glen Ellen

- South Elgin

- Downers Grove

State Farm Offers Life Insurance Options, Too

Providing for those you love is a big responsibility. You go to work to provide for them listen to their concerns, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Aurora Chooses Life Insurance From State Farm

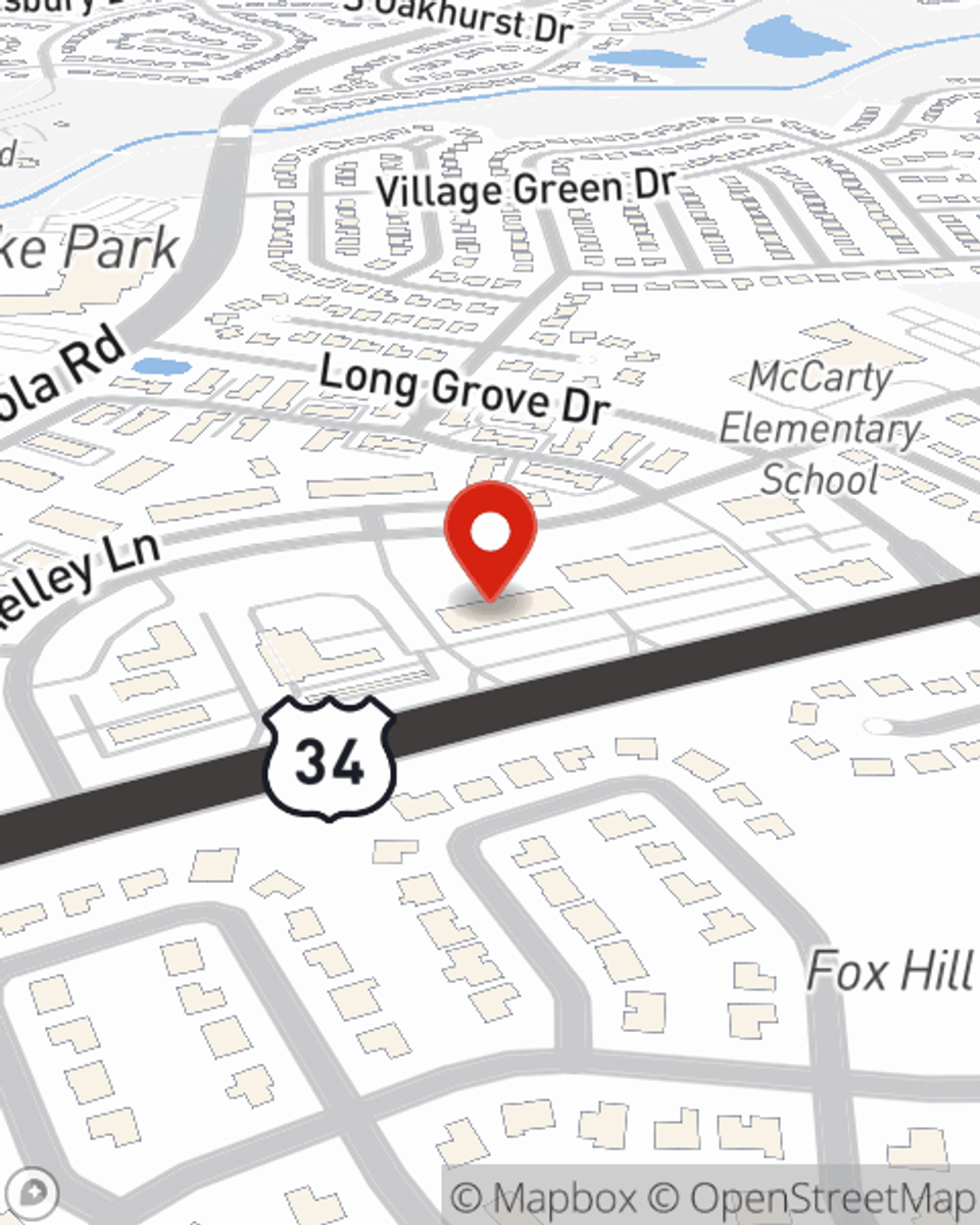

You’ll get that and more with State Farm life insurance. State Farm has fantastic policy choices to keep your family members safe with a policy that’s adjusted to accommodate your specific needs. Thank goodness that you won’t have to figure that out by yourself. With personal attention and excellent customer service, State Farm Agent Annie Kinsley walks you through every step to generate a plan that shields your loved ones and everything you’ve planned for them.

State Farm offers a great option for someone who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can come in handy by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For a free quote on Guaranteed Issue Final Expense, contact Annie Kinsley, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Annie at (630) 820-5400 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Annie Kinsley

State Farm® Insurance AgentSimple Insights®

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.