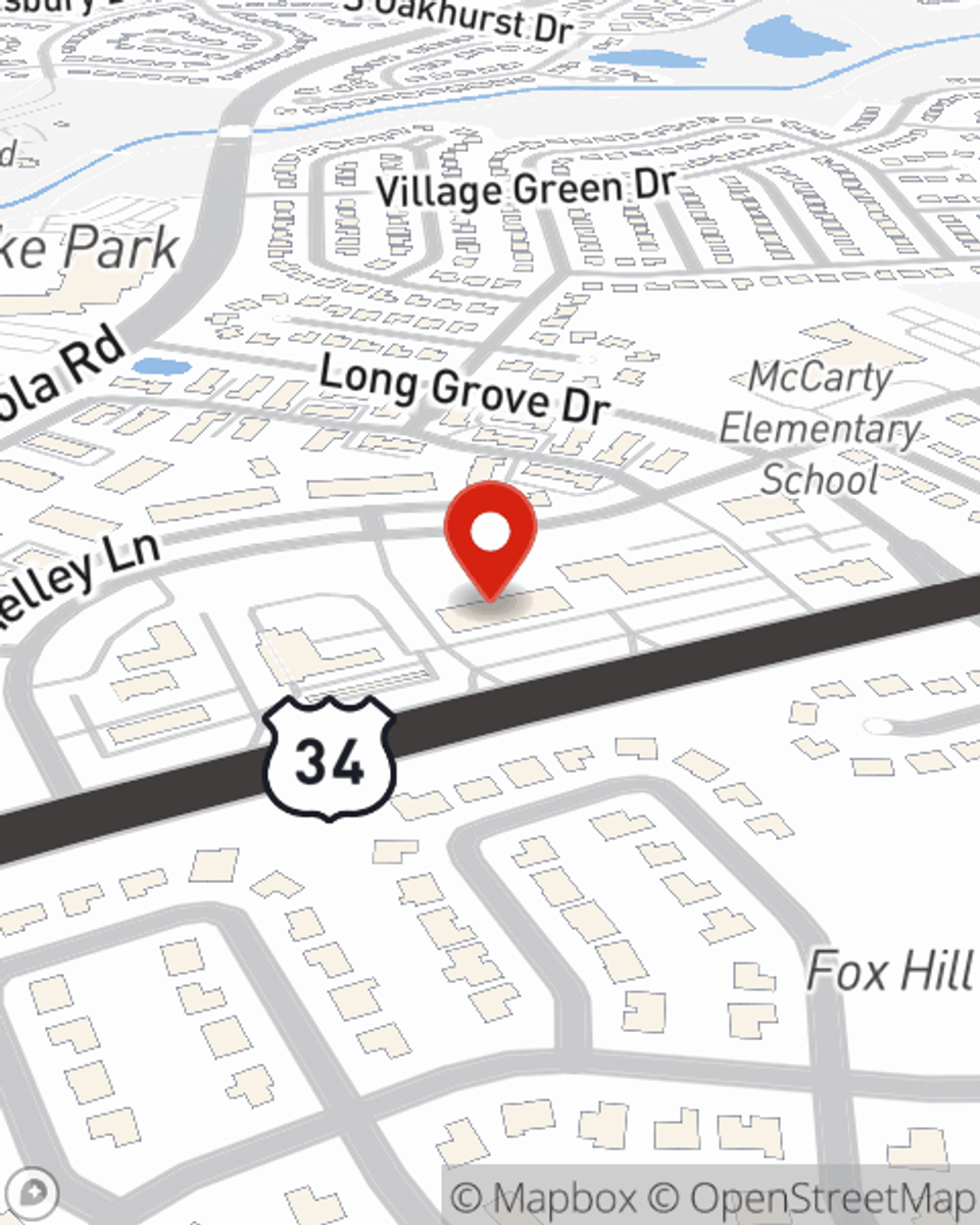

Business Insurance in and around Aurora

Looking for small business insurance coverage?

Cover all the bases for your small business

- Naperville

- Aurora

- Montgomery

- Oswego

- Sugar Grove

- Yorkville

- Plainfield

- Bolingbrook

- Joliet

- Crest Hill

- Romeoville

- Lisle

- Batavia

- Woodridge

- Warrenville

- Wheaton

- DuPage County

- Will County

- Kendall County

- Kane County

- North Aurora

- Glen Ellen

- South Elgin

- Downers Grove

Coverage With State Farm Can Help Your Small Business.

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Annie Kinsley help you learn about terrific business insurance.

Looking for small business insurance coverage?

Cover all the bases for your small business

Cover Your Business Assets

If you're looking for a business policy that can help cover business liability, buildings you own, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

At State Farm agent Annie Kinsley's office, it's our business to help insure yours. Call or email our terrific team to get started today!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Annie Kinsley

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.